Aire Tax uses high quality tax software to ensure all personal tax returns submitted to Canada Revenue Agency are accurate and complete.

What makes us different to other firms:

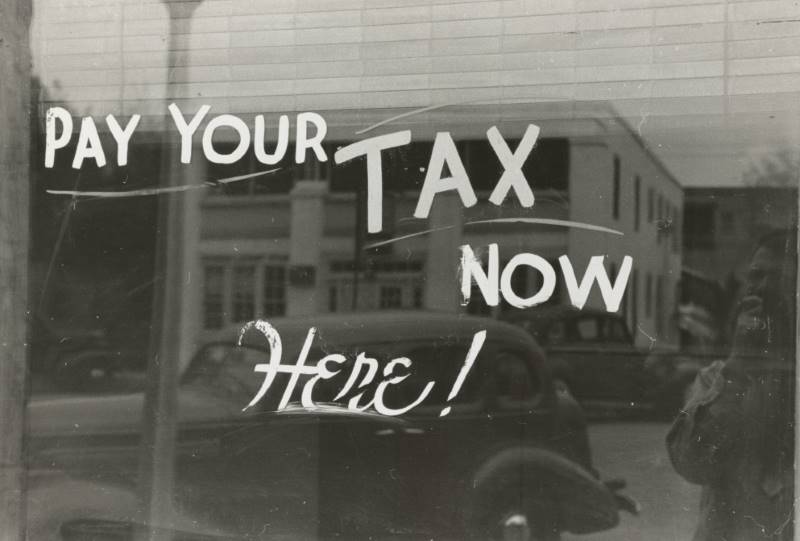

The deadline to file your personal taxes is April 30th each year. We recommend submitting all relevant documents at least 30 days before the deadline to ensure the return is submitted on time.

The deadline to file taxes if you or your spouse or common-law partner are self-employed or if you own a rental property, is June 15th. We recommend submitting all relevant documents at least 45 days before the deadline to ensure the return is submitted on time.

All payments to CRA are due April 30th each year even if your return is due June 15th.